The loss of a loved one is an emotionally challenging experience, and the added responsibility of managing their estate can further complicate matters. When inheriting real estate, the process of selling the property can seem daunting, especially if you’re unfamiliar with the legal and financial complexities involved.

This comprehensive guide will equip you with the knowledge and insights to navigate the inheritance process and sell your inherited property in Virginia efficiently and stress-free.

Understanding the Legal Process

The first step in selling an inherited property in Virginia is understanding the legal implications. If the deceased left a will, the property will be distributed according to the terms of that will. In the absence of a will, the state’s laws of intestacy will determine who inherits the property.

Once the heirs have been identified, they may need to go through the probate process to transfer ownership of the property officially. Probate is a court proceeding that ensures the deceased’s debts are paid and that assets are distributed to the rightful heirs. The probate process can vary in length depending on the complexity of the estate, but it typically takes several months to complete.

Timeline for Selling an Inherited Property

The time it takes to sell an inherited property in Virginia depends on several factors, including the property’s condition, the current real estate market conditions, and the complexity of the estate. The entire process should generally take anywhere from six months to two years.

There are several steps involved in selling an inherited property, including:

- Probate (if required): This can take several months, depending on the complexity of the estate.

- Preparing the property for sale: This may involve making repairs, cleaning, and staging the property.

- Marketing the property: This could involve hiring a real estate agent or listing the property yourself.

- Negotiating and accepting an offer: This could take several weeks or months.

- Closing the sale: This typically involves signing paperwork and transferring ownership of the property.

Tax Implications

You may be subject to capital gains tax when selling an inherited property. Short-term Capital gains tax is levied on the profits you make from selling an asset. The amount of capital gains tax you owe will depend on how long you held the property and your tax bracket.

If you inherited the property from a surviving spouse, you may be eligible to file separate tax returns and claim the head of household filing status. This can help you reduce your tax liability.

If you are considering selling a house you inherited, it is important to consult with a tax advisor to determine your potential tax liabilities. Consider hiring a real estate agent to help you market the property and negotiate the best possible selling price.

Selling an inherited home can be a complex process, but it is possible to do it successfully with careful planning and preparation. By understanding the legal and tax implications, you can avoid potential problems and ensure you get the most out of the sale.

Estate Taxes and Other Considerations

When selling an inherited property, you may be subject to estate taxes. The amount of tax credits will depend on the property’s value and your total estate’s value. In Virginia, there is no state estate tax, but there is a federal estate tax deduction. The federal estate tax exemption is currently $12.06 million, which means that estates valued at less than this amount will not owe any federal estate tax.

In addition to estate taxes, you may also be subject to capital gains taxes when you sell the property. Capital gains taxes are levied on your profits from selling an asset. The amount of capital gains tax you owe will depend on how long you held the property and your tax bracket.

Sold Ease: The Fastest Way to Sell Your Inherited Property

Navigating the complexities of selling an inherited property can be overwhelming, especially if you’re dealing with grief or emotional stress. Sold Ease, a leading real estate investment company, simplifies the process by offering a streamlined and transparent way to sell your inherited property quickly and for a fair price.

Sold Ease’s experienced team will handle all aspects of the sales process, from evaluating the property’s condition to preparing it for sale, marketing it to potential buyers, and negotiating and closing the deal. We will work closely with you throughout the entire process, ensuring that you are kept informed and comfortable every step of the way.

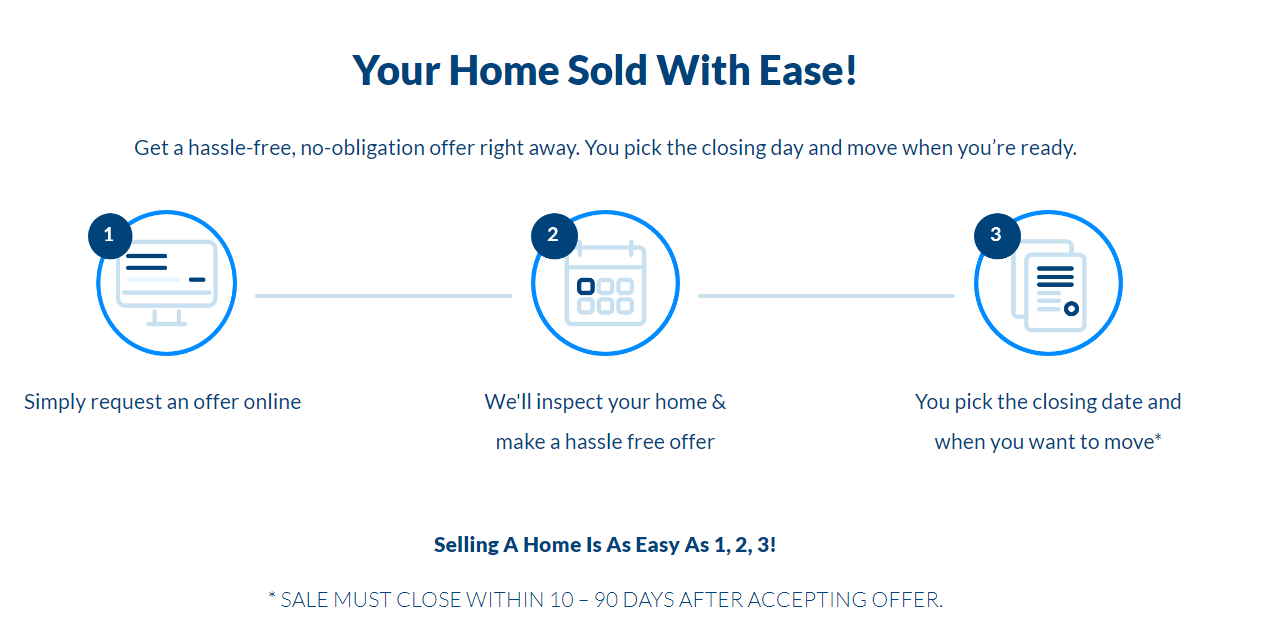

The Sold Ease Process

Alternative Ways to Sell Your Inherited Property

While Sold Ease offers the fastest and most convenient way to sell your inherited property, other options are also available. These include:

- Hiring a Real Estate Agent: A real estate agent can help you market your property to potential buyers and negotiate the best possible price. However, this option can be time-consuming and expensive.

- Selling the Property Yourself (For Sale by Owner): This option can save you money on commission fees, but it requires more effort and expertise on your part. For example, planning open houses.

- Selling the Property to a Cash Buyer: Cash buyers can often close on a property quickly, but they may offer a lower price than you would get on the open market.

Why Sold Ease Is the Best Option

Sold Ease, a leading real estate investment company, offers a streamlined and transparent way to sell your inherited property quickly and for a fair price. Contact Sold Ease today to get started.

- Fast and convenient: Sold Ease can close on your property in as little as seven days.

- Stress-free: Sold Ease will handle all aspects of the sales process so you can focus on grieving your loved one and moving on.

- Fair price: Sold Ease will offer a reasonable price for your property based on its current market value.

- No hidden fees: There are no hidden fees or commissions with Sold Ease.

Sold Ease is the best option if you’re looking for the fastest, easiest, and most stress-free way to sell your inherited property in Virginia. Contact Sold Ease today to get started.

In addition to the benefits listed above, Sold Ease also offers a number of other advantages, including:

- A team of experienced professionals who will handle all aspects of the home sales process

- A commitment to transparency and communication

- A proven track record of success

If you’re ready to sell your home in Virginia, contact Sold Ease today to get started. We will make the process as simple and stress-free as possible.