When selling your home, one of the most pressing questions is, “How much money will I make from the sale?” This question becomes even more crucial when considering selling your home to home buyer companies. In this article, we’ll explore the financial implications of selling your home, mainly through home buyer companies, and why it might be a lucrative option for you.

Understanding Home Sale Economics

Home selling involves various costs, from Real Estate agent fees to home staging expenses. These costs can significantly impact the final amount you receive from the sale. Additionally, the potential profit depends on factors like your home’s market value, outstanding mortgage, and the costs associated with the sale.

The Traditional Home Selling Process

Traditionally, selling a home involves hiring a Real Estate agent, whose fees typically range from 4% to 7% of the sale price. Preparing your home for sale, including repairs and staging, also incurs costs. Moreover, the traditional process can be time-consuming, affecting your financial planning.

The “As Is” Home Sale Advantage

Selling your home “as is” to home buyer companies offers a stark contrast. This method involves selling your home in its current condition without costly repairs or upgrades. It’s a straightforward process that can be more efficient and less stressful than the traditional route.

Why Choose Home Buyer Companies in Norfolk, VA?

Home buyer companies specialize in quick sales, often making cash offers. This eliminates the need for Real Estate Agents and their commissions. Additionally, you can bypass the costs and time involved in home staging and repairs.

Financial Implications of Selling to Home Buyer Companies

When you sell to a home buyer company, you typically receive an immediate cash offer. This can be particularly advantageous if you need quick access to funds. While the offer might be below market value, the reduced selling costs and transaction speed often balance this out.

Choosing a home buyer company in Norfolk can lead to significant financial benefits. These companies often cover closing costs and eliminate Real Estate agent commissions. Additionally, they can offer competitive prices for homes near key attractions or in desirable neighborhoods.

Let’s picture this…

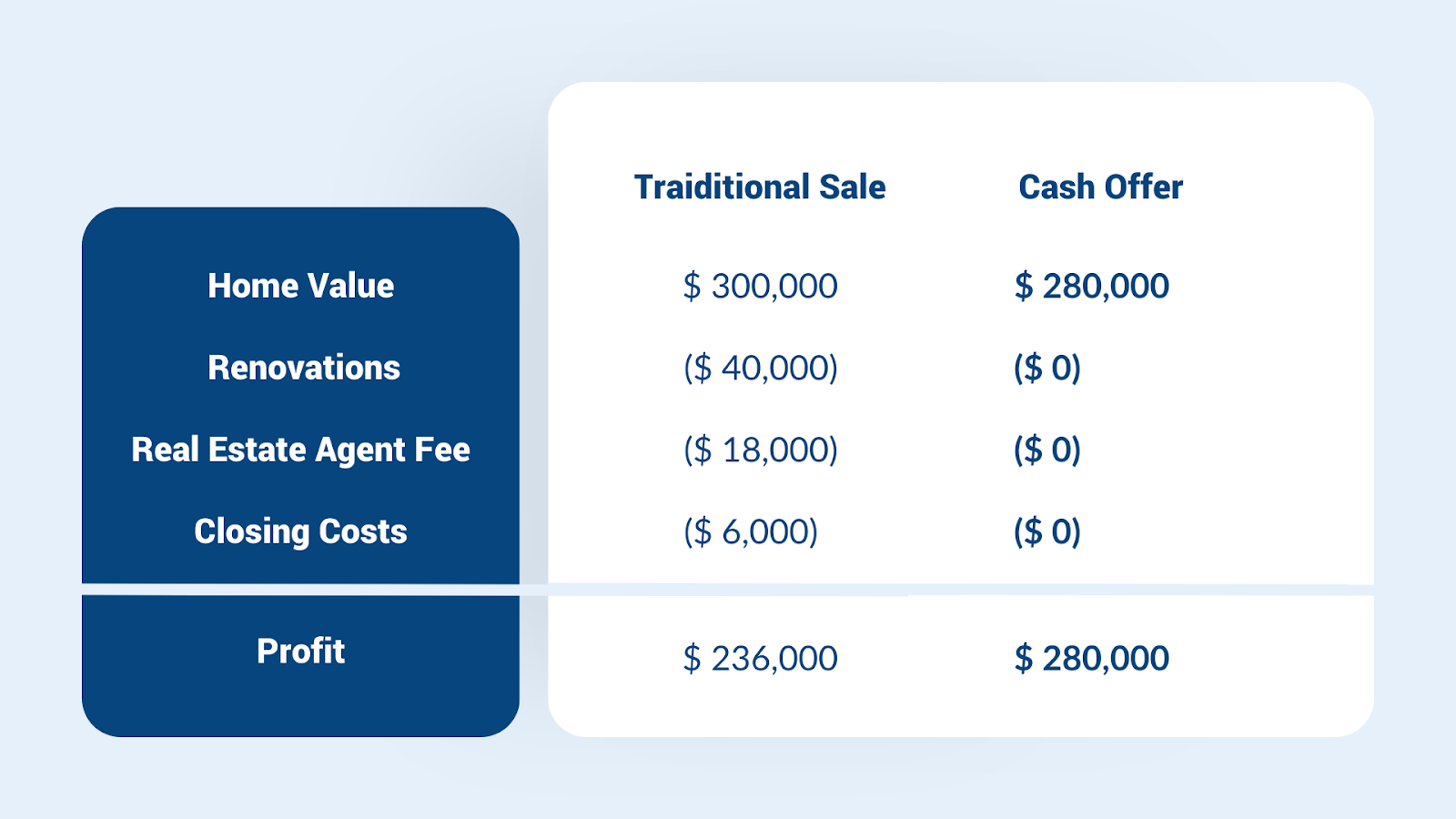

Consider the story of John, a Norfolk homeowner. John decided to sell his 1940s home in the Colonial Place area. The traditional market route suggested a potential sale price of $300,000 but required $40,000 in renovations and repairs. After factoring in Real Estate commissions (6%, amounting to $18,000) and closing costs (2%, roughly $6,000), John realized his net profit would be significantly reduced.

Instead, John opted to sell his home to a local home buyer company for a slightly lower offer of $280,000. However, he ultimately netted more from the sale by avoiding repair costs, commissions, and closing fees.

Understanding Market Trends

Market conditions play a crucial role in home sales. You might get higher offers in a seller’s market, but the quick, guaranteed sale to a home buyer company can be more appealing in a buyer’s market.

Tax Implications of Selling Your Home

When selling your home, considering the tax implications, such as capital gains tax, is essential. However, if you’ve lived in your home for two of the last five years, you might be exempt from this tax on profits up to a specific limit.

Preparing for the Sale

Before selling, gather all necessary documentation, such as your deed and mortgage information. Understanding the sale’s legal aspects is crucial to ensure a smooth transaction.

Negotiating the Best Deal

There’s room for negotiation even when selling to a home buyer company. Research the market value of your home and be prepared to discuss terms to secure the best possible deal.

The Closing Process

The closing process with home buyer companies is typically faster and less complicated. However, be aware of closing costs that can affect your net proceeds.

Post-Sale Financial Planning

After the sale, it’s essential to manage the proceeds effectively. Consider your financial goals, whether buying another property, investing, or saving for the future.

Conclusion

Selling your home, especially to a home buyer company, can be a financially sound decision. It offers speed, convenience, and, often, a more straightforward financial outcome. By understanding the process and your options, you can maximize the money left from the sale of your home.

Get a hassle-free, no-obligation offer!